Last Will and Testament in Thailand

Last Will and Testament in Thailand. A Last Will and Testament (พินัยกรรม) in Thailand is a legally binding document that allows a testator to determine the distribution of their assets upon death. Thai law recognizes both domestic and foreign nationals’ rights to make wills for property located within the Kingdom. However, given the interplay between […]

Divorce in Thailand

Divorce in Thailand is governed by the Civil and Commercial Code. The procedures may differ for Thai nationals and foreigners. It is important to be aware of the different types of divorce and the potential complexities involved. Types of Divorce for Thai Citizens When both parties to the divorce agree to the divorce and all […]

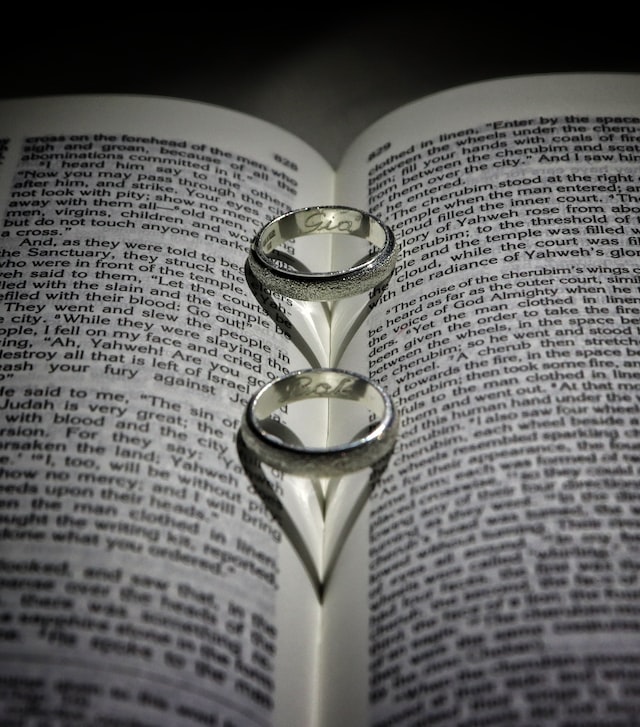

Importance Prenuptial Agreement in Thailand

It is important to have a prenuptial agreement in place before you marry. It can help you ensure that your assets are divided fairly and equitably in the event of divorce. It can also prevent you from having to deal with a large debt that your partner may have. A prenuptial agreement should be drafted […]

Process of Preparing a Prenuptial Agreement in Thailand

In Thailand, it is mandatory to register a prenuptial agreement before getting married and noting it on the marriage certificate. This ensures that the government knows about the existence of the marriage and will be able to notify the public if a divorce takes place. A Prenuptial Agreement is an agreement between two parties prior […]